Clubbing Entrepreneurially: My Experience Navigating the Startup Ecosystem with the Entrepreneurship Club

A Journey Through Entrepreneurship and Venture Capital at Ashoka University

Hailing from Mumbai, the ‘City of Dreams,’ I was naturally drawn to the transformative potential of small ideas evolving into impactful entrepreneurial ventures. This ability to drive innovation and create a more equitable and sustainable society fueled my passion to gain a deeper understanding of the start-up ecosystem.

I was excited by the financial field having pursued commerce in high school, but I wanted to pursue a program which allowed the freedom to explore various career paths, attend enriching seminars, and become a part of diverse communities. Thus, Ashoka’s liberal arts program was undeniably a perfect choice. While the academic foundation courses provide a gateway into different subjects, the Entrepreneurship Club immediately appealed to me because it provides a space for like-minded individuals to connect and collaborate in addition to offering a platform to access resources, gain knowledge, and engage with entrepreneurs and investors. Additionally, I found myself gravitating towards the Venture Capital Vertical because of the pivotal role played by venture capitalists in identifying, nurturing and giving wings to innovative ideas.

Choosing the venture capital vertical felt like a natural extension of my curiosity about how businesses grow and how innovation is funded. I wanted to understand the key factors that investors consider when backing a startup—be it the founder’s vision, the product-market fit, or the scalability of the business model. Being part of the club’s venture capital team has allowed me to engage with experts through the biweekly fireside chats we host with various inspiring entrepreneurs and finance professionals – including Mr. Sanjeev Aggarwal – the founder of Helion Ventures, Mr. Dhruv Ranjan – the Associate VP of Anicut Capital and Mr. Himanshu Goyal – a partner at PWC amongst multiple distinguished individuals. Their diverse insights allowed me to deepen my understanding of the startup ecosystem.

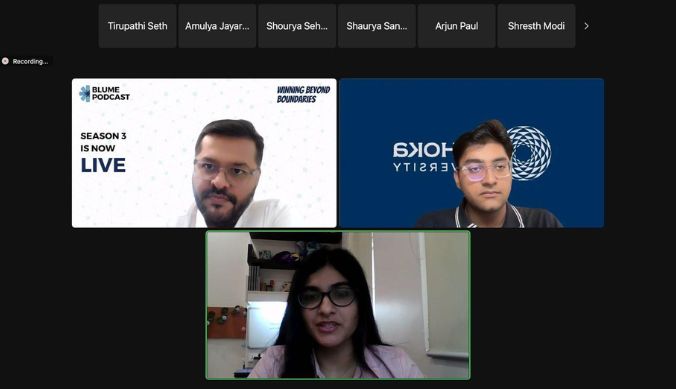

One of the most valuable experiences was hosting a speaker session with Mr. Mitul Mehta, the Finance Head of Blume Venture Capital, one of India’s leading venture capital firms. This event was a turning point for me, as it gave me an opportunity to look at the intricacies of the venture capital world while interviewing a seasoned professional. He shared the strategic thinking behind Blume’s investments, explaining how they assess startups in their early stages and decide which companies have the potential for growth and scalability. Mr. Mehta emphasised that successful venture capitalists don’t just look for a good product—they look for the founder and team’s ability to adapt and execute.

This reinforced the idea that a startup’s success depends not only on its ideas but also on the founder’s leadership, perseverance, and vision. Another important lesson I learned was how venture capitalists take a long-term approach to growth, especially from Blume’s belief statements which assert that they remain steadfast supporters to founders, staying invested for anywhere from eight to ten years, and as long as the founders are equally invested in their ambition for the business, offering not just financial support but strategic counsel and guidance. When I reached out to him after the session and expressed my interest in continuing the engaging conversation he hosted and having a deeper discussion on some of the insights he shared, he warmly invited me over to meet him at his Mumbai office during the winter break. This was a unique opportunity to learn and build my network by engaging with such a knowledgeable figure.

Looking ahead, I hope to deepen my knowledge in several areas through my involvement with the club. The Entrepreneurship Club has been instrumental in providing an exposure to venture capital and providing an opportunity to learn from the experiences of others, which I plan to make the most of these interactions through the course of my years at Ashoka. As I continue to learn and grow within this space, I am excited about the future and the opportunities that lie ahead in entrepreneurship and venture capital.

Writer:- Arushi Vyapak- First Year UG 2024

Study at Ashoka